When it comes to managing employment and benefits, contacting the Human Resources (HR) department is often essential. For employees or potential hires at Wells Fargo, understanding how to reach the HR department can simplify many processes, from addressing payroll issues to discussing career development opportunities. This guide will provide you with the key information about the Wells Fargo HR phone number and additional contact methods.

Why You Might Need the Wells Fargo HR Phone Number

Whether you are a current employee, a former employee, or a prospective job candidate, there are several reasons you might need to contact Wells Fargo HR:

- Employment Verification: For verifying employment history or details for new job applications.

- Payroll and Benefits Issues: For resolving issues related to salary, benefits, and retirement plans.

- Workplace Concerns: For addressing workplace grievances, discrimination, or harassment issues.

- Career Development: For inquiries about training programs, promotions, and career advancement.

How to Contact Wells Fargo HR

Wells Fargo HR Phone Number

The primary Wells Fargo HR phone number for employee support is 1-877-HRWELLS (1-877-479-3557). This number connects you to the Wells Fargo Employee Resource Center, which can handle a wide range of HR-related inquiries.

Additional Contact Methods

In addition to the phone number, Wells Fargo provides several other ways to get in touch with HR:

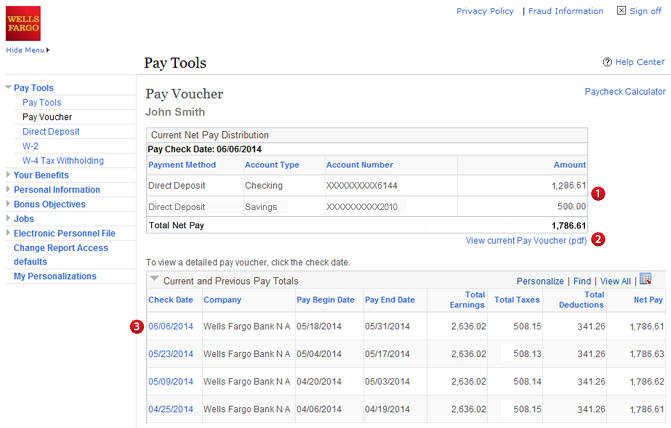

- Online HR Portal: Current employees can log in to the Wells Fargo Teamworks website to access HR resources, submit requests, and find answers to common questions.

- Email: For non-urgent matters, employees can send inquiries to the HR department via email. This email address is typically found within the internal employee resources.

- Mail: Traditional mail can be sent to Wells Fargo’s corporate headquarters or specific HR offices, if necessary. The address for the corporate headquarters is:

Tips for Contacting Wells Fargo HR

- Have Your Information Ready: When calling, have your employee ID, relevant personal information, and any documentation related to your inquiry ready to expedite the process.

- Be Clear and Concise: Clearly state the purpose of your call or message to ensure you are directed to the appropriate department or individual.

- Follow Up: If you don’t receive a response within a reasonable time frame, follow up to ensure your inquiry is being addressed.

Conclusion

Contacting Wells Fargo HR is straightforward when you know the correct phone number and alternative contact methods. The HR department is there to assist with various employment-related issues, ensuring that employees' concerns are addressed promptly and efficiently. Remember to utilize the online resources available to you for quicker resolutions and to follow up on any pending issues.

By using the information provided in this guide, you can confidently reach out to Wells Fargo HR for any support you need.

.jpg)